Last Updated on: 22nd November 2023, 05:54 pm

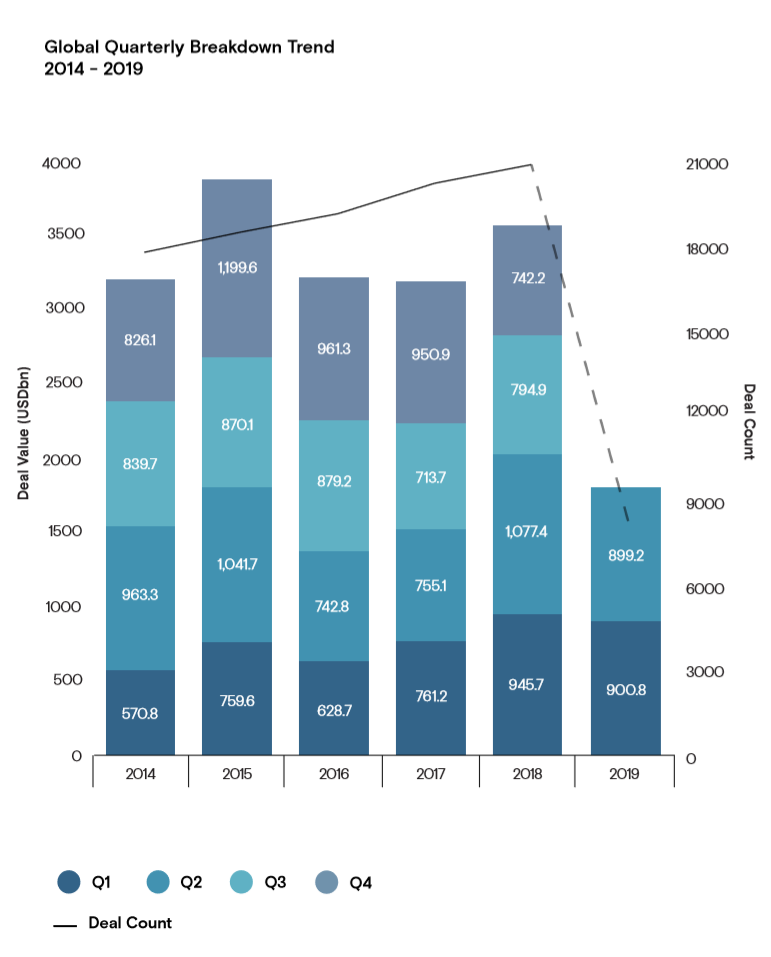

Mergermarket, the leading provider of M&A data and intelligence, has published its Q2 2019 report in which all but one of the ten largest deals targeted US-based companies, six of which were the result of domestic consolidation. Amid heightened geopolitical risks and rising protectionism, global cross border activity has accounted for just 33% of dealmaking this year, compared to a yearly average of 38.7% since 2010. Worth a combined USD 5.9bn over 43 deals in 1H19, Chinese outbound investment into the US and Europe was particularly subdued, reaching lows not seen since 2009.

The US took its largest ever share of global M&A value during 1H19, with 53.2% (USD 957.3bn in total global deal value). This was as much to do with its own 14.6% increase on last year’s showing as it was the downturn in Europe and Asia –38.8% and 34.2% lower respectively.

Although not reaching 2Q18 record levels (USD 180.1bn), at USD 133.6bn, global private equity buyout value in 2Q19 surpassed that recorded in the previous two quarters (USD 111bn in 4Q18 and USD 111.5bn in 1Q19). Three mega-buyouts have already been struck in the US so far this year – the same number as for the whole of 2018 – including two large cross-border take-private deals in 2Q19: the USD 14.2bn acquisition fiber networks operator Zayo Group by a EQT/Digital Colony Partners consortium and the USD 10.2bn acquisition of midstream oil and gas pipeline operator Buckeye Partners by Australian IFM Investors.

Beranger Guille, Global Editorial Analytics Director at Mergermarket commented: “Perhaps a sign that de-globalisation forces are starting to permeate corporate strategies, several large companies, sometimes under activist pressure, are using M&A to strengthen their grip on their home markets or focus on their core businesses.”

Other key data points include:

- Down 11% on 1H18 but up 17% on 2H18 by value, global M&A activity would appear to have found its post-peak cruising speed in 1H19, recording USD 1.8tn worth of deals (across 8,201 transactions).

- Global demergers reached their third-highest value on record, with 11 deals worth USD 98.3bn in 1H19.

- With 1,307 deals so far this year, the Technology sector globally was responsible for 15.9% of deal activity by volume in 1H19, its highest share on record. The sector has notably become private equity’s favourite hunting ground in recent years, accounting for 23.2% of all global buyouts so far this year, up from only 12.8% in 2013.

Please click here to see the full global report for more insights.