Last Updated on: 22nd November 2023, 06:30 pm

Quanloop adopted a unique method to diversify portfolio for their investors. Many platforms offer investors to dilute risks on their investment; however, much of it is just simply a function without adequate protection. Quanloop’s diversification vastly differs from the mainstream, and it will be discussed as to how they are different from the rest when it comes to portfolio diversification.

Investors join an investing platform with the expectation of earning money. They also expect to do it without significant risks; hence, they rely on many platforms’ diversification features. Most platforms offer both manual and automated diversification for stable returns. Still, the investors fail to realise that they can only pick and choose investment by interest target, investment term, and some background on the investment project. Investors are unable to diversify their portfolio by risk factors.

Quanloop steers away from this mistake and offers investors to set their portfolio not only by interest rates but also based on risks. Before discussing Quanloop’s technique, let’s explain what overlooking risk factors can do to a portfolio.

Risk factors in portfolio diversification

If investors are not aware of risk factors in projects, it can lead to big mistakes, affecting their ROI. They may end up picking many assets of the same class or with the same risk characteristics, thinking that they have diversified and diluted the risks. Hypothetically, this could bring in significant profit when the market is pushing the asset class upwards. But if the economy crashes, the assets will respond inversely to the same economic event, making this diversification expensive and completely obsolete.

Investors are also unaware of risk-exposure in their chosen investment that needs to be adjusted. Instead of taking a portion out of everything, investors tend to select investments with adjusted volatility. The low volatile investment is not enough to counterbalance the high volatile one; therefore, they need to pick a project that will cushion them in the event of a loss.

It applies to all investments, both traditional and alternative.

Quanloop bridging the gaps of diversification

Quanloop is an online investment platform that allows people to invest with them to earn money. They gather capital from investors and invest them in partner projects, mostly business loans, to get returns with higher interests. Once Quanloop receives the credit back with higher interests, they pay the investors with their interests and other profits.

Quanloop avoids the gap of diversification by adopting a two-fold structure:

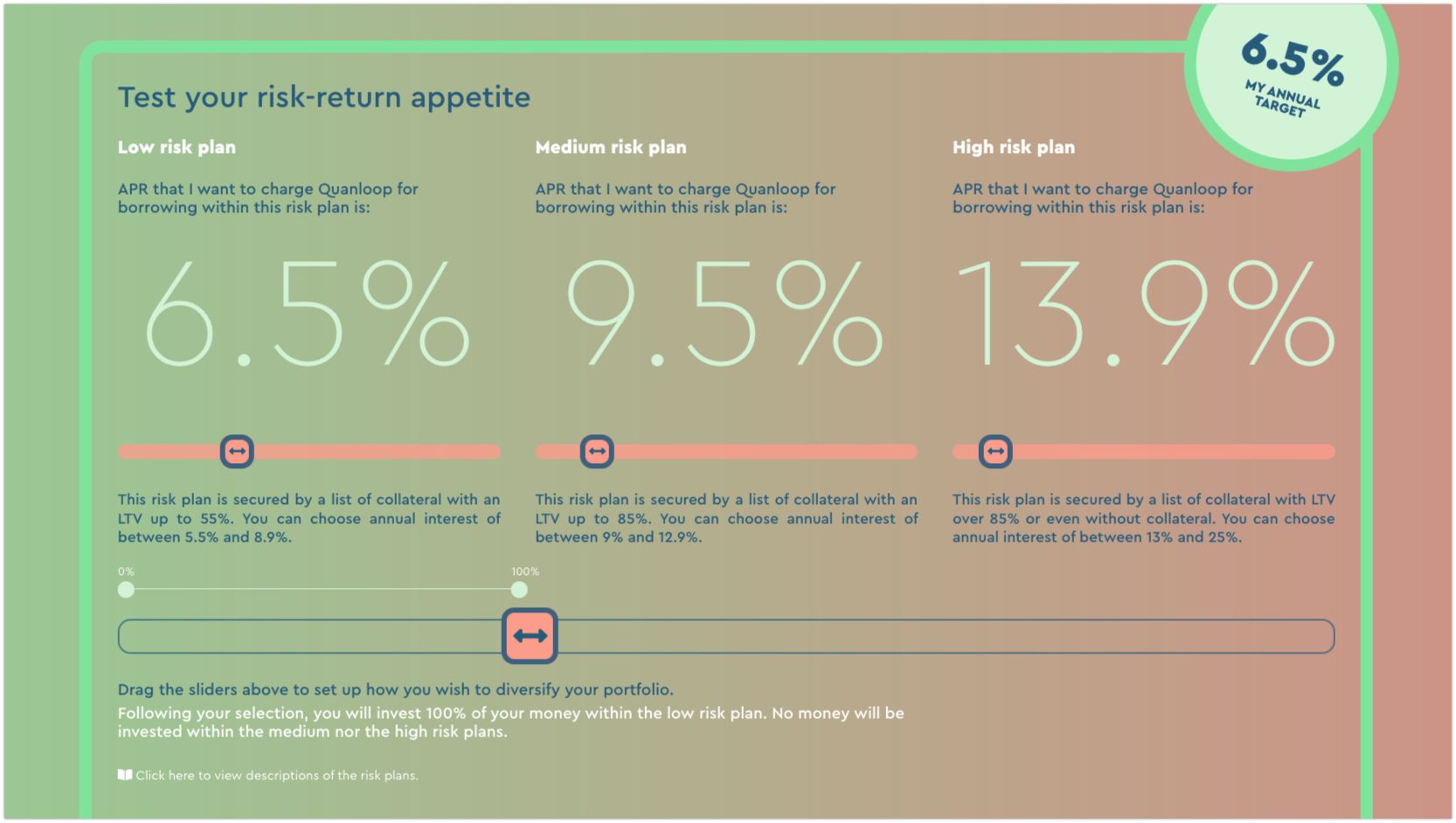

- They do not invest in the same asset class projects or with similar risk characteristics. They finance projects with leasing and factoring companies of various assets – tangible and intangible and some crowdfunding projects. They divide the projects into three risk characteristics – low, medium and high;

- They only fund riskier projects when the investor permits it, lending only 1/3 of the investor’s money to higher-risk projects and 1/2 to medium-risk projects. Investors cannot gamble away all of their money in medium and high-risk – a different setting none of the investment platforms have. Here, investors can see what kind of risk their investment amount will undertake.

Investors may stress about the lack of descriptions of the projects in which Quanloop is investing. However, they do not need to worry about it for several reasons:

- They choose their projects on a very selective basis. Their partners are reputable companies around Europe;

- When Quanloop invests with the Partners, they hold their assets as collaterals. In the event of default, Quanloop will seize those assets and liquidate them to pay the investors;

- Quanloop is the sole borrower of the money, solely liable to the investors and not any third parties. In the event of default, Quanloop will compensate investors from their own reserves in addition to the collaterals;

- In the event of insolvency, all the investors’ capital will be returned to them immediately. This is only possible because Quanloop keeps the investors’ money in a separate client account that is only to be used for investment and not cover Quanloop’s debts.

Their system effectively limits exposure to risks without sacrificing their returns. They have further implemented additional secured measures to cover all circumstances of losses to facilitate limiting the risk factors. Some may even think that it is a stretch, but if it decreases risks and brings stable returns, your portfolio is optimally diversified.

They also offer other benefits, such as high liquidity, referral profits and cashback compensation for value lost to inflation. If you would like to know more, check out their website www.quanloop.com.