Last Updated on: 11th April 2024, 04:08 pm

When entering the cryptocurrency sector, individuals and entities constantly face the question of whether to trade or invest in digital assets. The choice between buying and selling cryptocurrencies for short-term profit (trading) and adopting a long-term strategy (investing) depends on various factors. These are risk tolerance, market knowledge, and financial goals. This article will explain the distinctions between crypto trading and investing, helping market participants choose the best option.

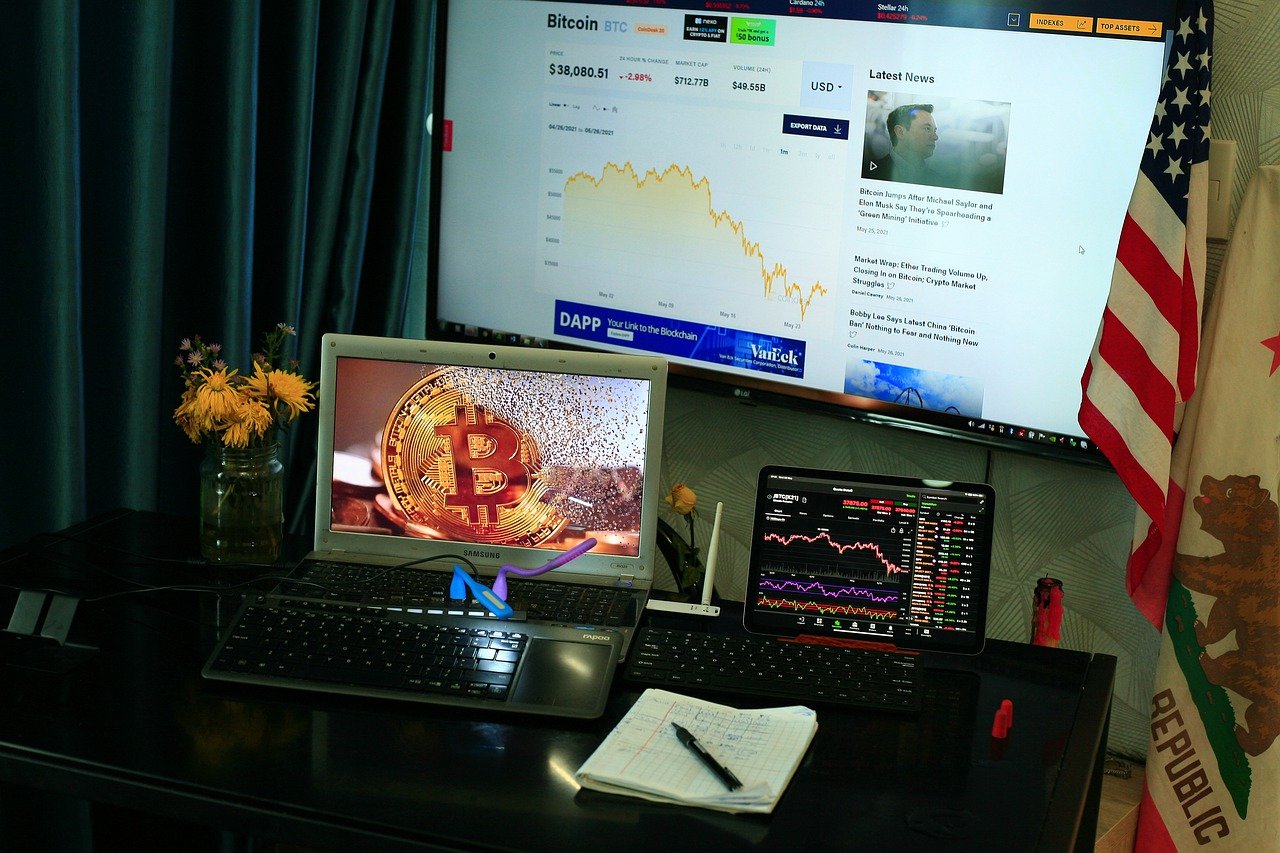

Trading on the Crypto Market: A High-Stakes Timing Game

Crypto traders thrive on the volatility of the crypto market, leveraging fluctuations in asset prices to generate profits over short periods. That may take from minutes to several days. This practice necessitates a profound understanding of market trends, technical analysis, and the ability to act swiftly on market movements. Traders employ strategies such as:

- arbitrage;

- position trading;

- day trading;

- swing trading;

- scalping.

Traders capitalize on price discrepancies across exchanges and fleeting market opportunities. Trading’s essence lies in accurately predicting price movements, requiring expertise and real-time decision-making skills.

High-frequency traders utilize powerful computers and algorithms to execute many trades at extremely fast speeds. These traders capitalize on minimal price differences across exchanges, often holding positions for mere seconds or milliseconds. They often act as liquidity providers and market makers, operating on DeFi platforms or centralized exchanges like the WhiteBIT crypto market making company.

Crypto Investing: For Those Aimed To Build Wealth Over Time

Investing is a strategic approach focused on the long-term potential of digital assets. Investors delve into cryptocurrencies’ foundational technology, market positioning, and growth prospects to identify projects with robust fundamentals. The strategy revolves around the belief in selected assets’ underlying value and future growth, often leading to a “buy and hold” approach. Investing demands patience and a resilient mindset to withstand market volatility. Investors use strategies like dollar-cost averaging and value investing, which are prevalent among those seeking to build wealth over time.

Choosing Between Trading and Investing

Let’s bring all the gathered information into a table for clarity:

| Risks | Strategies | Timeframe | Frequency | |

| Invest | Higher risks (continuous market monitoring, high-stress level) | Short-term strategies like day trading, swing, scalping, etc. | Short term | High |

| Trade | Lower risk, lower stress | Buying and holding or investing a fixed amount month-by-month, Index fund investing, etc. | Long-term | Low |

As we can see, each option has distinct characteristics and requirements. For example, trading involves higher risk and necessitates constant monitoring of the market, employing short-term strategies. This approach is high-frequency, demanding lightning-fast decision-making and a tolerance for stress due to the volatile nature of the market.

Investing, conversely, is marked by a long-term perspective with lower risk and stress levels. Strategies such as buy-and-hold or monthly contributions (dollar-cost averaging) aim for gradual portfolio growth with less frequent transactions. This method suits those looking for steady, compounded growth over time.

Deciding whether to trade or invest depends on one’s risk appetite, time commitment, and financial goals. For crypto market newcomers, a cautious strategy like regular, fixed-amount investing can offer a simpler entry point. This approach reduces the need for precise market timing and can lower the average cost of investments over time. Success in both trading and investing requires a disciplined approach, a deep understanding of market principles, and strong risk management.