Last Updated on: 21st November 2023, 10:17 pm

Mortgage approvals in the UK continue to decline, with net approvals dropping from 49,500 in July 2023 to 45,400 in August 2023, following a previous decrease to 54,600 in June 2023. Open Property Group has conducted research into the current state of mortgage approvals in the UK and has gained exclusive insights from industry experts. Here’s what the experts had to say:

Question 1 – Do you forecast an uplift in UK Mortgage Approvals within the next 12 months?

Ben Grey from CHN Financial Consultancy expressed a pessimistic view, stating, “I would say the opposite. I think the real issue we are starting to see is not only issues for applicants but issues where valuers are concerned. Clients are having offers accepted on what appears to be fair market conditions, but the surveyors going out and valuing properties on behalf of lenders are being extremely cautious, with no sign of this slowing down, and quite often this means buyers are needing to either find extra cash which isn’t available or attempting to renegotiate the price, which is particularly difficult right now.”

In contrast, Mark Hansard from First Financial holds an optimistic view, saying, “I do think we’ll see an approval uplift, yes. We are in a period now where people have accepted slightly higher rates. I don’t think we will see the rates of 0.85% – 1.5%, for a long time. There is a lot of stock on the market at the moment with Buy-To-Let landlords selling off some of their portfolios so a great chance for first time buyers to get on the ladder.”

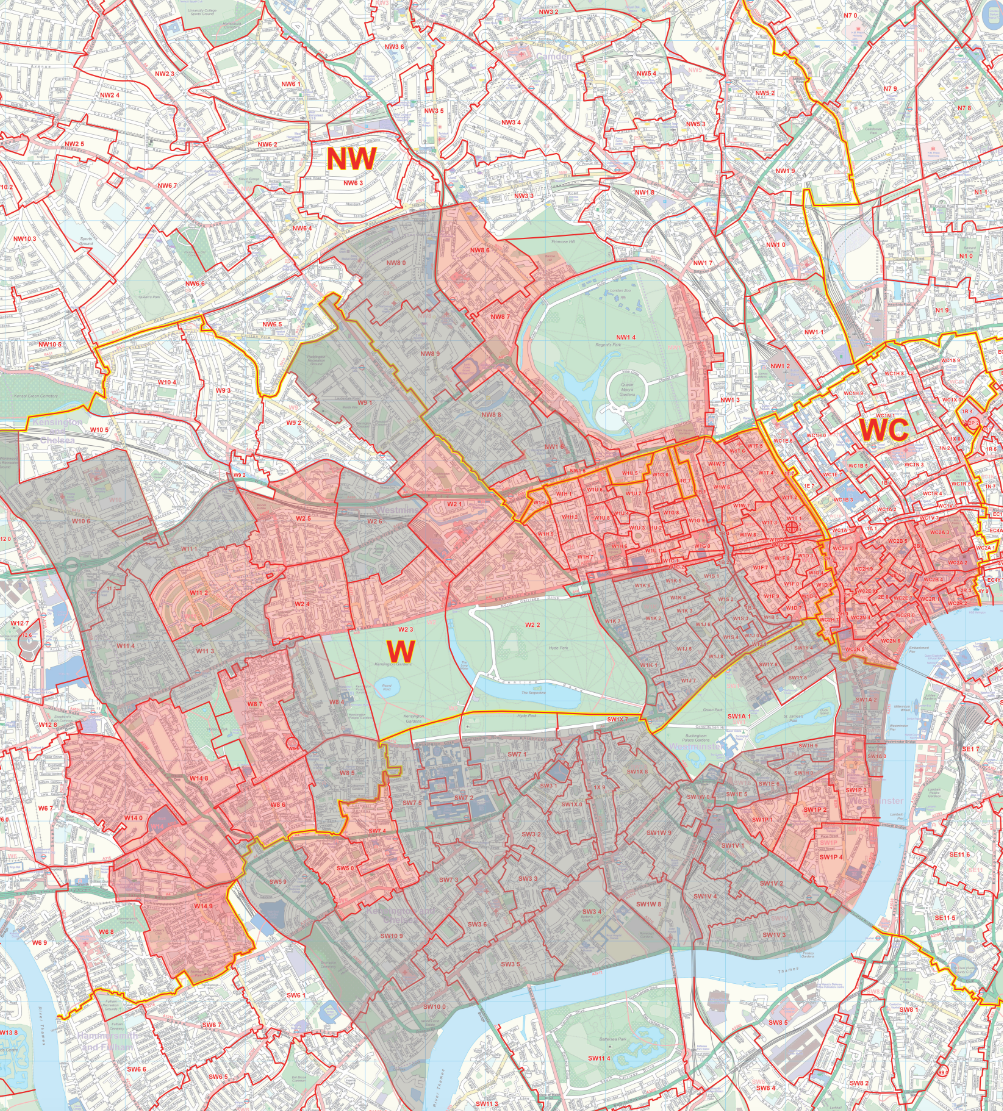

Question 2 – Have you spotted any Mortgage Approval patterns across specific regions?

Ben Grey from CHN Financial Consultancy believes that the strictness of valuations is not necessarily region-based, but he has noticed that areas with slightly inflated house prices in recent years are facing stricter valuations.

Question 3 – Have you spotted any Mortgage Approval patterns based on property type?

Wayne Hill from M&G Mortgages notes, “Of the transactions we have done, more people do appear to be turning to flats than houses.”

Question 4 – Have you spotted any Mortgage Approval patterns based on first-time or second-time buyers?

Wayne Hill from M&G Mortgages observes, “Of the approvals we have done, more are for first-time buyers than second-home movers. Those with existing ownership are cautious about taking the next big step, doubling their mortgages, especially with rates doubling from what they are used to.”

Mark Hansard from First Financial discusses the ‘new normal,’ stating, “Some lenders offer an increased income multiple if earnings are over a certain amount and some lenders are increasing how much clients can put on interest only, if there is a suitable repayment vehicle in place. I don’t think it’s a bad thing if first time buyers are getting used to rates between 3%-4.5%.”

Open Property Group, specialists in helping homeowners sell their houses quickly regardless of the economic climate, believes that despite ongoing market uncertainty, there is a clearer understanding of what the ‘new normal’ in terms of interest rates will be compared to 12 months ago. Opinions vary, but fluctuating market conditions suggest a more cautious outlook than a bullish one.

You can read the full Expert Commentary Q&A on this topic on the Open Property Group website: https://www.openpropertygroup.com/landlord-hub/uk-mortgage-approvals/