Last Updated on: 29th September 2024, 09:47 am

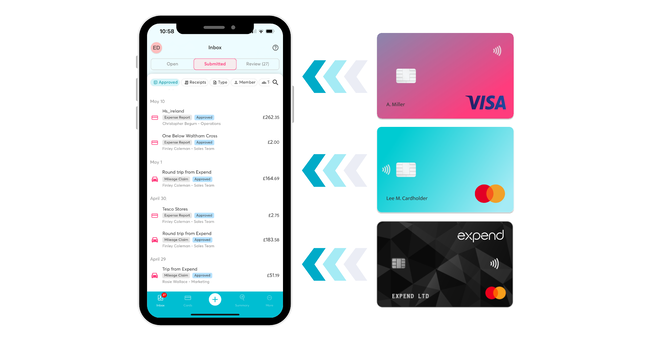

Expend, the digital platform specialising in business expense management, has reported record adoption of its industry-first ‘Card Connect™’ product. The UK-based platform is now able to instantly process expense data from Mastercard and Visa transaction feeds directly into its expense management system.

The latest update enables Expend customers to benefit from real-time processing of their expenses, significantly improving efficiency and financial management.

Johnny Vowles, CEO of Expend, said: “Card Connect has two important attributes. It enables companies to connect all of their business cards to our single platform, which has multi-card acceptance. This means that users can view and submit all of their expense claims in one app, whether, for example, they paid on their corporate Barclaycard or business HSBC card.

“The second is that these card payments can be viewed in the app instantly, as they happen. There is no wait time between making the payment and seeing it in the Expend app.”

Vowles went on to explain: “Employees can charge business expenses to their Visa or Mastercard business cards, and by linking them to Expend, the transaction data is processed instantly. Users can attach receipts, categorise the expense, and submit it for approval via the app immediately after the transaction. For instance, they can submit an expense for team coffees before the drinks are even served.”

He added: “Managers and finance teams can view all submitted expenses from multiple cards in one place, streamlining the approval and accounting reconciliation process. This eliminates the need for multiple logins and banking apps, simplifying the overall workflow.”

Discussing the drawbacks of traditional expense management, Vowles remarked: “Traditional expense management is an ‘eye roll’ moment for firms of all sizes, and their employees. Paper-based receipts, clunky claims processes, and long sign-off routines create headaches and delays for finance teams and colleagues. However, with Expend’s Card Connect, we are continuing to revolutionise the expense management market.”

He further commented: “Clients appreciate the flexibility of using their preferred business cards, especially those that accumulate rewards like travel points. Expend’s card-agnostic platform allows companies to switch to Expend while still using their existing credit card options without any friction.”

Traditionally, finance teams spend considerable time managing business credit card expenses, often manually matching payments to bank statements. Expend’s Card Connect removes this burden, reducing the risk of errors caused by manual entry.

Vowles explained: “With Card Connect, whenever a Mastercard or Visa Business Credit or Debit card linked to the company’s Expend account is used, the recipient receives a notification to upload the receipt and submit it through the Expend app.”

He concluded: “Expend Card Connect continues our mission to improve real-time visibility and zero-touch processing of personal expenses, addressing a vital customer need.”